How to Succeed at Your Legal Strategy or What You Need to Know When Opening Your Company

Four legal aspects to consider when opening your company that will ease your work and save you from legal troubles.

Starting your own business is an important moment in your life. Whatever service you want to provide from this moment on, planning and strategising become your best operational friends.

Most people deal with legal matters only at a later stage in the life of their startup. But while this can save you some money in the short term, it can cost your company more money on the longer course. We talked already about the due-diligence on your previous contractual relationships - to know what you can and can't do in the future and how to protect yourself strategically and your business strategically - this is what you should start in the first place.

After you've finished with the analysis on your previous agreements, a practical next step is to put on paper (or laptop) everything you would have to deal with, legally speaking, within the following months. Or the months before to bring your value to your clients.

1. Let's start with the beginning. Where do you want to register your business?

Starting with this information, you will have the framework of the regulations to follow to run your operations smoothly and legal. The place where you decide to register your business has much impact in various fields of your business:

- Do you have to register your entity, and how to do it?

- What and how much taxes you pay?

- What are your legal obligations as a freelancer?

- What types of contracts do you need to conclude with your clients?

- How do you end your agreements - in writing, by email, verbally?

And so much more.

That’s what we do at Avoteca, facilitating access to good legal services by helping you get in touch with lawyers that can take this burden off your shoulders. Especially for tax purposes, the best way to choose a place of business that fits your needs is to collaborate closely with a legal professional that advises you on all your obligations, depending on their national rules.

If you are a UK national, for example, but want your place of business to be in France, you will have to contact an attorney from France (or a French attorney located in the UK) to advise you on your long-term duties, not just the short-term ones.

After you decide where you want to register your firm, you must settle on the actual location. Here are some options:

Coworking Spaces

Choosing a coworking space as your business place is the easiest way to advance faster into your activity. Coworking spaces are lively environments. Not only that they bring support in opening your office - some of them even offer the possibility to register your company at their headquarters - but they also enrich your social interactions through thematic events and networking meetings.

However, there are some legal aspects that you need to consider when delivering your services from a coworking space.

First, you need to be sure about the rules of the space and what do you receive in your package, for example:

- When can your clients come to a meeting?

- Do they need to schedule their visit in a particular calendar?

- Can they roam around the space, or they have a designated area for visitors?

- Who is responsible for the other guests in case your clients misbehave?

- Who is accountable if something happens to your clients while in the coworking space?

- What about if they are in your private office situated in the work location?

- Do they need to sign some particular papers when they enter the coworking space, such as a confidentiality agreement for everything they hear around?

- Are you required to add some specific clause into your service agreements related to your relationship with the coworking space?

Coworking spaces try not to burden the founders and freelancers who enter their community, so there are probably not many specific rules. But to be sure you understand the house rules before signing a lease contract, the best is to ask.

If you don't intend to spend your time in the coworking space but just need a business location, you better inquire about their conditions and whether it is an accepted practice.

Traditional Office Spaces

When choosing to rent a traditional office, the matters to consider are not significantly different from those from a coworking space. In such a situation, you might want to be sure to run your business from that location. Most of the time, the rent is much higher than in a coworking space, especially if we talk only about the service of registering your company to the location.

It is vital, like in coworking spaces, what the lease contract says. Make sure you read it carefully. And if there are confusing rules or uncovered situations - even when they look silly - try to negotiate the agreement.

What you should also be careful about is what is included in your rent. Some office spaces don't include the price of the internet cost, coffee, phone calls - national or international -, or printing and scanning services. Even the cleaning can be added as a supplementary fee.

Living Spaces

When you decide to register your company at the same place you live, you should not be paying any rent from your company, depending on the legal system.

Sometimes it is enough to simply prove that you live there and have the right to register a business at the same address. How can it happen? You either own the location, or you rent the apartment and the landlord grants you this right in the lease agreement or in a bailment deal for real estate purposes (in some countries, it is legally valid agreement).

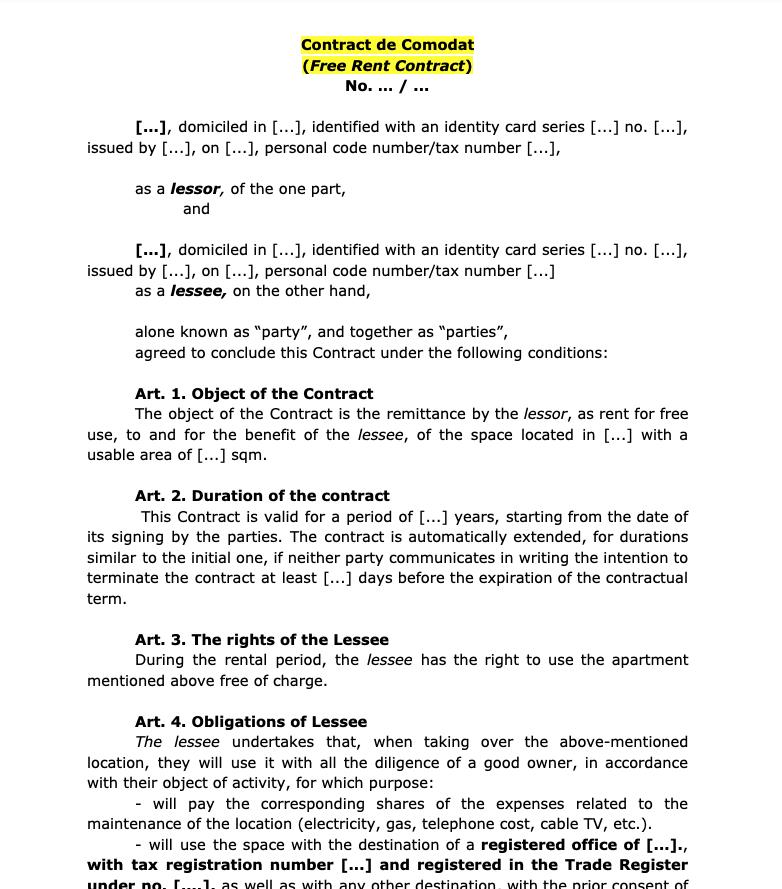

In the Romanian legal system, a person can register their business in a location that they own or at a friend's or parents' house, for example, if they conclude what it is called a contract de comodat. A contract de comodat allows the transfer of a property from a bailor, who temporarily waives possession but not ownership, with a particular purpose, in this case, for the registration of the business activity.

We prepared a template that you can use if you decide to register your own company in your private home location and, of course, if your business's legal system allows it. The agreement is in English, but, for the sake of accuracy, we left the Romanian title of it - contract de comodat. Please change it with whatever status is allowed in your country. If you need it in another language, don't hesitate to use translation software before revising it.

Download the contract de comodat (free rent contract) PDF - DOCX

2. What legal entity should you create?

As mentioned earlier, the answer to this question depends very much on the location of your business. Globally, there are some similarities in various countries.

Limited Liability Company

The main particularity and the reason many persons choose a limited liability company to the detriment of a sole entrepreneurship entity is that the liabilities are strictly split between the company and the owners. It means that in case of debts or payments due, the company's creditors cannot turn against the shareholders to recover their debt, but only against the company and its capital.

Depending on the country, different rules apply to limited liability companies, such as the process or the legal documents needed to be signed by the shareholders at the registration moment.

Sole Entrepreneur - Freelancers’ entity

Some countries require it, some not; in some, you can provide service from tomorrow; in some, you still need to have a legal entity in that matter. Regardless, there is no longer a split between the natural person's liabilities and the legal person's. The aforementioned implies that in case of trouble, like debts or payments due, the creditors can turn against you personally. You will need to pay your debt considering all your patrimony and not only upon the activity you provided as a professional.

As a freelancer or creative business, you will want to choose between a limited liability entity and a solo entrepreneur type of service. Most commonly, freelancers start as solo entrepreneurs because they do not have to register at all their entity or the procedures are way more accessible. However, in the long term, the limited liability company advantages the business owner. It gives them more freedom, fewer taxes, and more protection.

In the community, you will find attorneys qualified to help you choose your legal entity and register it at the local authorities.

Do you want to open a business in Romania? Contact the qualified Romanian attorneys from Avoteca Legal Community, and they will be with you every step of the way.

Joint-stock Company

Even if the liability is also limited to the company's capital, the law usually exercises more control over a joint-stock company. It can be about the number of shareholders, the first capital amount to put into the company - most of the times a higher amount than for a limited liability company-, or the corporate governance rules determined by a large number of members and high amount of money that circulates

3. What is the activity you want to provide?

If you can start providing your services without registering any legal entity, then you're lucky! Go ahead, provide those services and start making some money!

On the other hand, if you must create a company, the business location's main activity will guide the procedures, documents, and authorisations you need before providing any of your offers.

How you plan to provide them - online, offline from your office, or offline from your client's office - is also an essential information to know when you register your entity. Following your freelancing activity or your online business's leading service, you might be required to conclude professional liability insurance.

All these matters weigh heavily from the very beginning, and it is essential not to take them lightly. After all, the goal is to have your business running smoothly and give your clients the best experience!

4. Invoicing rules

As part of your business strategy, you can ask your clients for a down-payment or retainer. Invoicing methods can become your number one concern before even starting to provide any of your services. Knowing in advance what you need to do and what to include in your invoice can save you a tremendous amount of time and stress when all you should be focusing on is your client.

Contracting with an international client brings even more laws to adhere to and information to add to your invoice. Even if it seems simple, billing can become complicated when your business's location is different not only from the place of service but from the place you live, where it's very possible to be tax liable.

For example, suppose you are located in the European Union, and you want to provide a service in another European Union country. In that case, you must be registered under a unique European VAT number. In the same way, if you buy services from another company located in another European Union state, not to pay VAT on top of the service’s cost, you must also be registered under this European VAT number. And this is only one of the examples when things can get tangled.

To conclude, remember to always have a strategic plan before starting your business, which should include answers to the following questions:

- Where do you want your business to be located, geographically wise?

- Where precisely do you want to register your company - coworking space, traditional office, home-based office?

- What activities do you want to provide, how do you want to offer them - online or office - and what are, if any, the particular legal regulations for such actions?

- What are the invoicing rules depending on your activity's specifics, your clients, and the means you render them?

(The template does not represent a legal consultancy and does not give raise to any obligations to anyone)

At Avoteca, we’re building a lawyers community with enthusiastic members that support and nurture independent legal professionals. Join us!

Ana-Maria Drăgănuță Briard

Lawyer & Co-founder of Avoteca | Podcaster at Legal Tale Podcast

24 March 2021